The UK used car market has gone through some challenging months – and one particular point of concern has been the values of used electric cars. In late 2022, values plunged (and leads dipped) thanks to hiked energy prices, lack of government-backed used car incentives and – even against the backdrop of falling values – comparatively high prices against diesel and petrol equivalents.

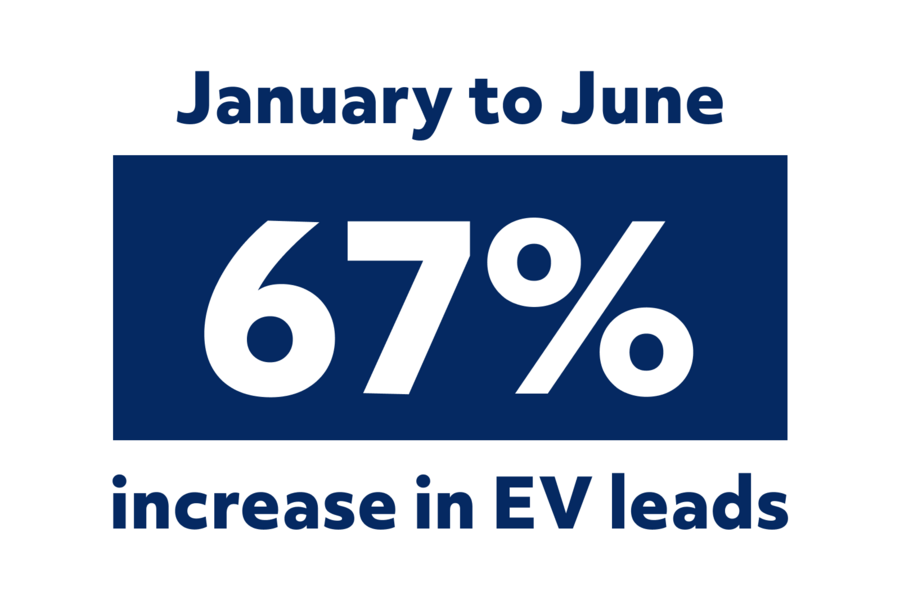

However, data in heycar’s Q2 2023 Headlights report suggests that the tide could finally be turning for used EVs: average prices on heycar jumped 4% between April and June, and leads skyrocketed 67% during the first half of the year. For discerning dealerships, this means that investing in used EV stock could be a smart move heading into the second half of 2023.

“Savvy dealers will take this as a sign that used EVs have a place on forecourts, which will inevitably grow over time,” says heycar CEO, Karen Hilton. “A quick glance at new car sales figures assures us that the ratio of electric to ICE is only going one way, and while we are not giving the all-clear on either EV values or consumer demand, there is no question that they will become far more common in the used car market as the decade progresses. The question, then, is how we make the most of them.”

That’s not the only shift in the used car market that’s useful to know. Data shows that interest in used diesels is on the rise, while used coupé values are trending upwards and general consumer should continue to grow, despite July’s small dip.

Compiled each quarter using a wealth of industry-leading expertise, the Headlights report offers a wealth of in-depth insight and analysis on the latest used car trends and must-know sales figures. So, to help your dealership navigate the current used car market and prepare for the rest of 2023, we’ve pulled together six of the most essential statistics from this quarter’s Headlights report to help power your business to success.

For even more in-depth market insight, view the full heycar Q2 2023 Headlights report

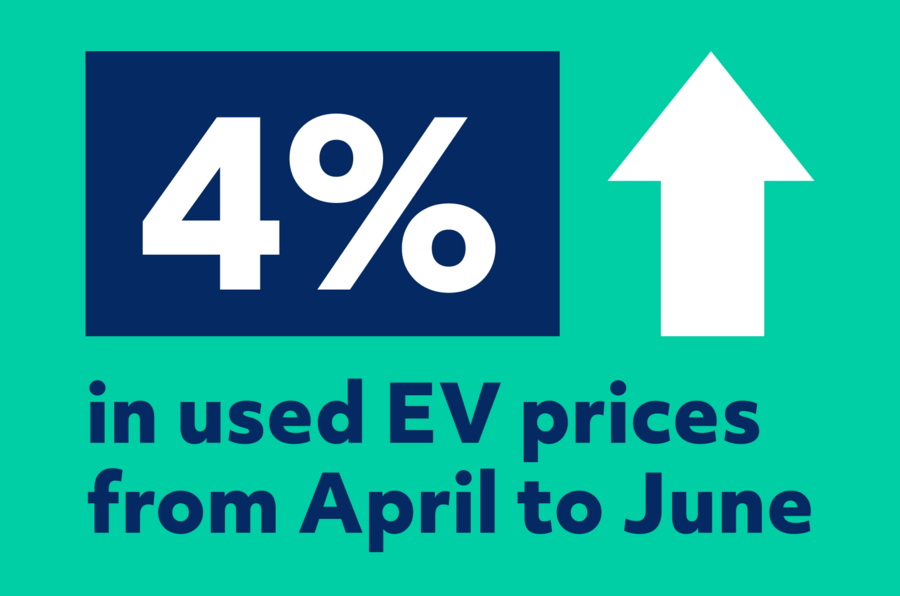

1. 4% increase in used EV prices

As we’ve covered, used electric vehicles experienced a slump in value from Q3 of 2022. High energy prices were mainly to blame, but no government-backed incentives for used buyers (Scotland aside), low consumer confidence and comparatively high prices (compared to petrol and diesel alternatives) all played their part.

However, month-on-month average values jumped by 2% to £29,947 in May, and by another 2% to £30,557 in June, leaving them 4% up on April’s figure of £29,363. While not conclusive, this could point towards greener pastures for long-term used EV values.

Falling energy prices for the first time in 20 months likely prompted the change. In fact, prices started to fall exactly two months before the reduction in the energy price cap – the maximum amount energy suppliers can charge customers per kilowatt hour – from £3280 in April to £2074 in July.

Add your comment