It’s no secret that the post-lockdown used car boom has throttled back in recent months. However, research from used car experts heycar suggests dealerships have reason to be optimistic heading into the rest of 2023.

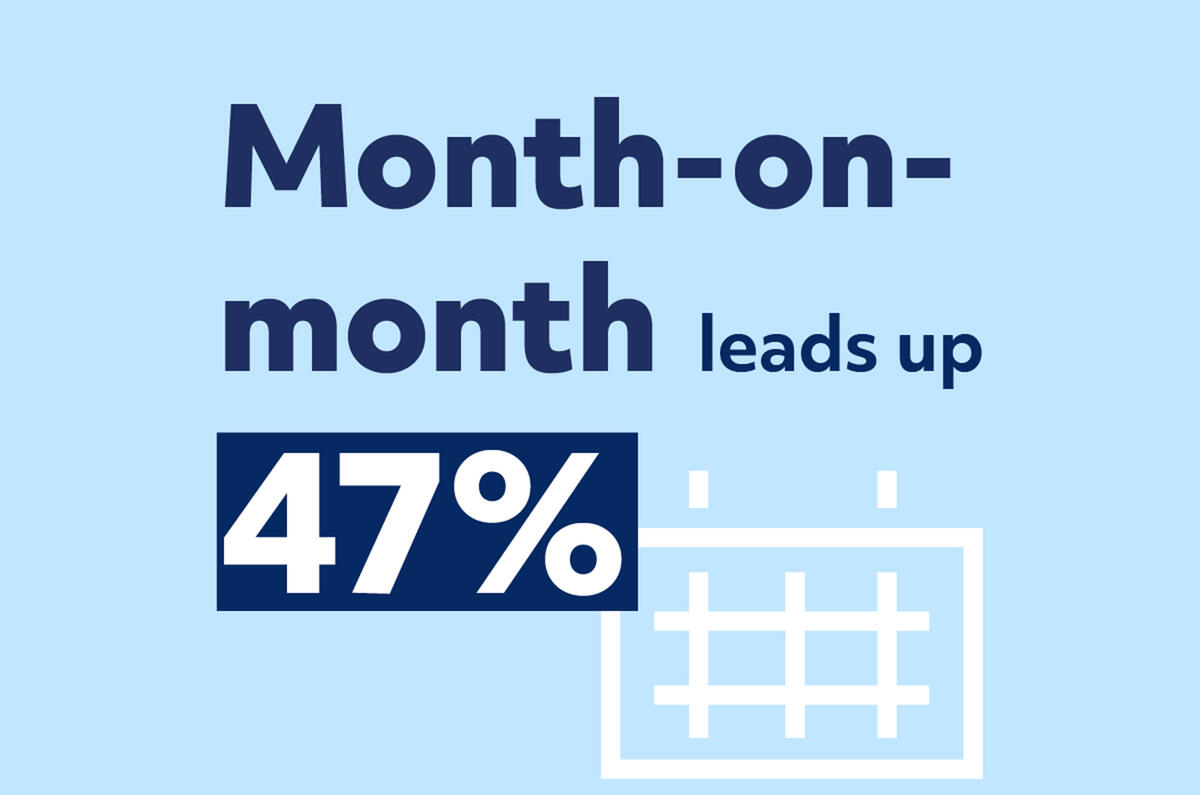

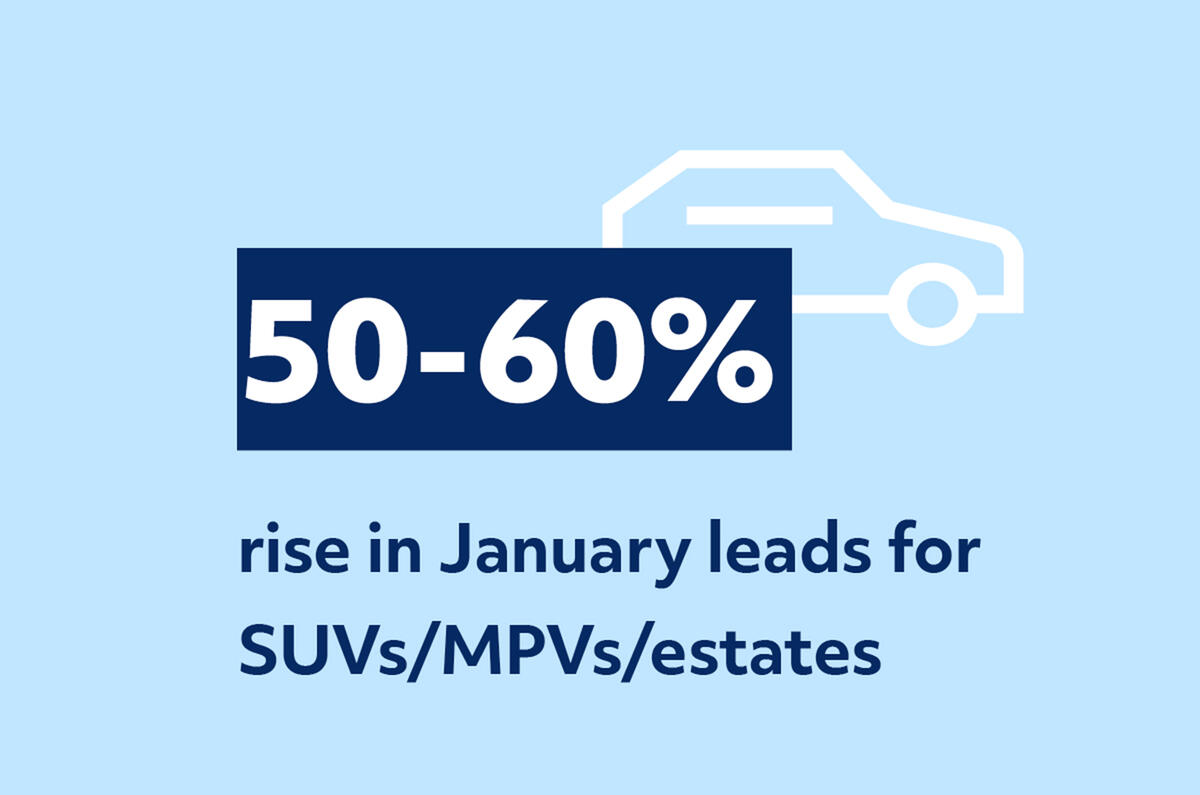

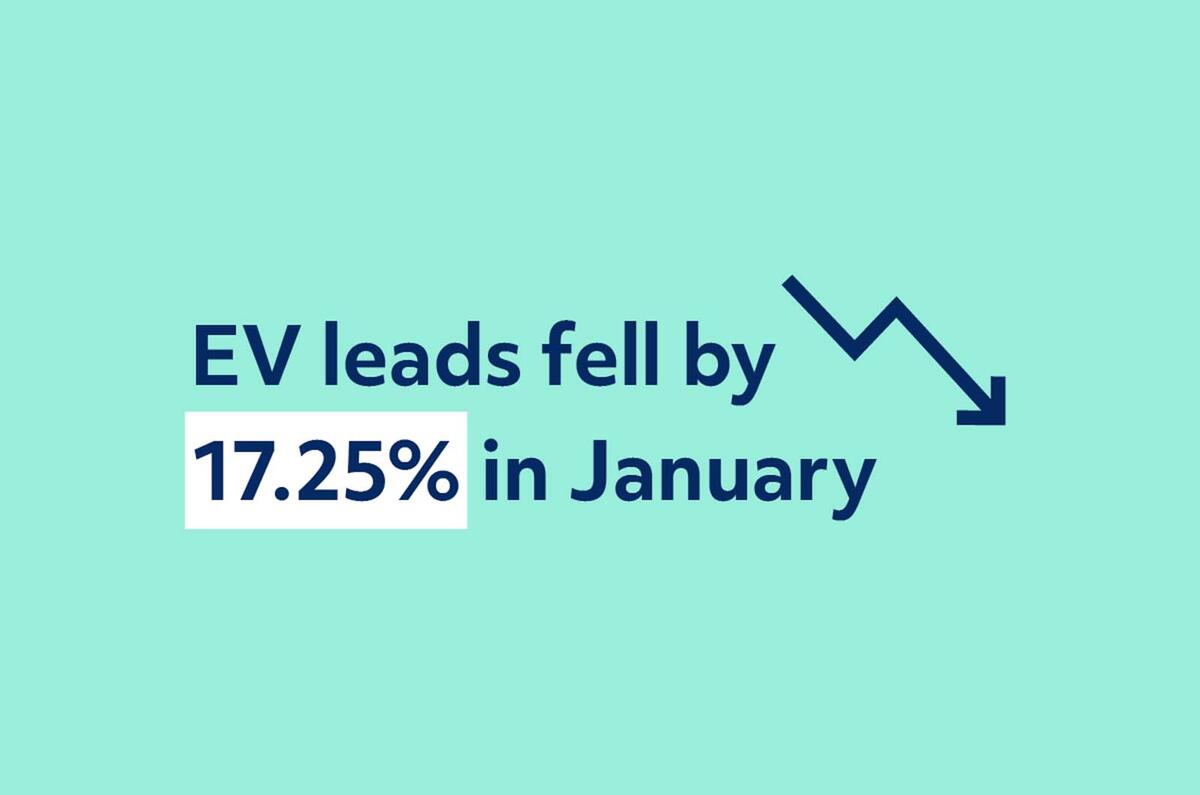

Highlighted in heycar’s Headlights report, there was an irrefutable upturn in leads and overall consumer interest in January compared to December. For discerning dealerships, this means that now is exactly the right time to identify and invest in the best quality used car stock. And if you want to know which cars consumers are searching for, that’s where the Headlights report can be of help.

Add your comment