What a difference a year makes. In spring last year, Tesla threw open the doors of its Texas Gigafactory to investors in order to lay out plans for global domination of the automotive industry with sales of 20 million a year.

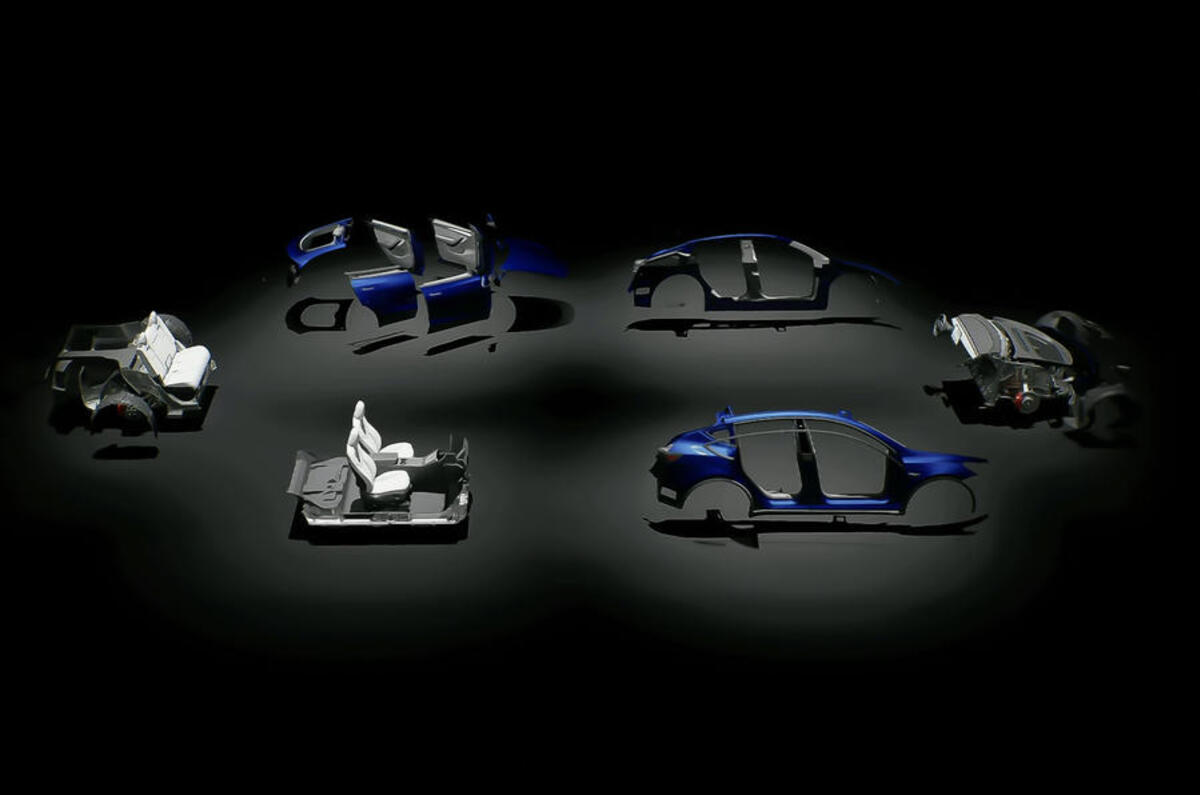

Now those plans – for a new Mexican plant, for an affordable ‘next-gen’ Model 2, for a new ‘unboxed’ production process, for more gigacasting – essentially lie in ruins.

Add your comment