UK-based catalytic convertor and hydrogen technology specialist Johnson Matthey has announced it will spend £80 million to build a new hydrogen fuel cell components facility in Royston, near Cambridge.

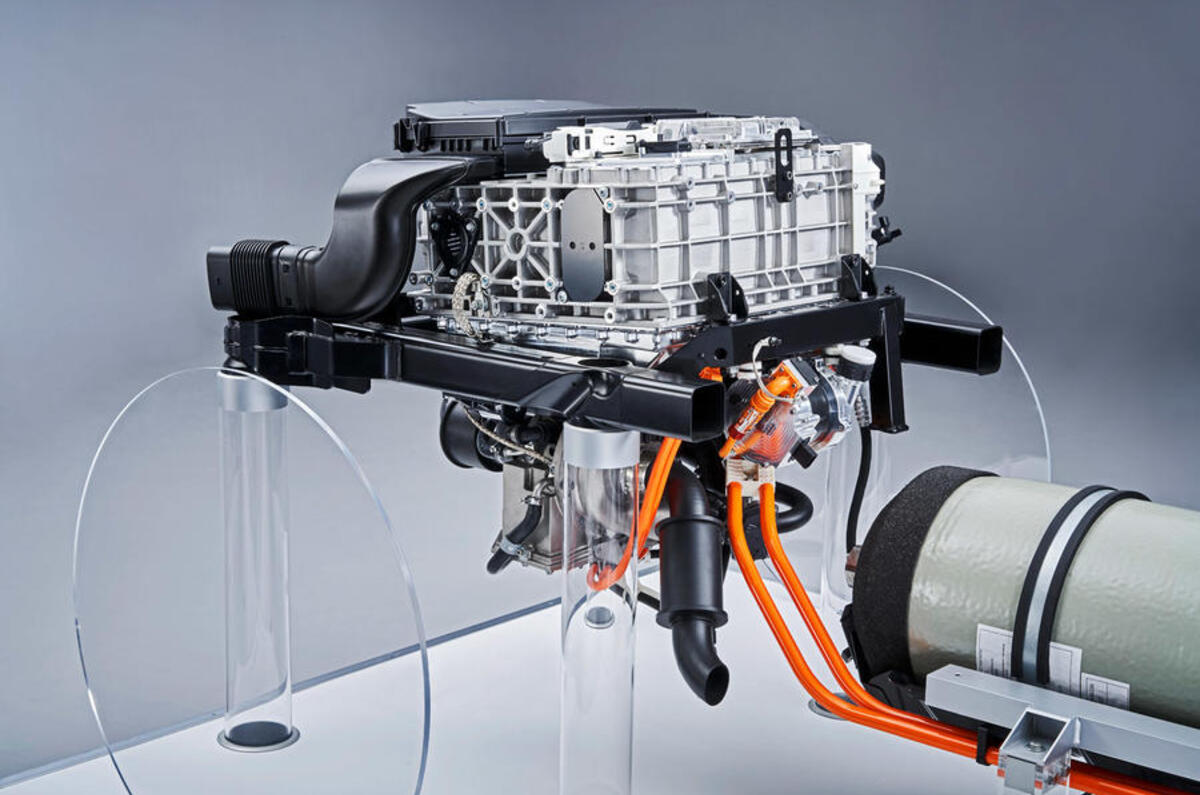

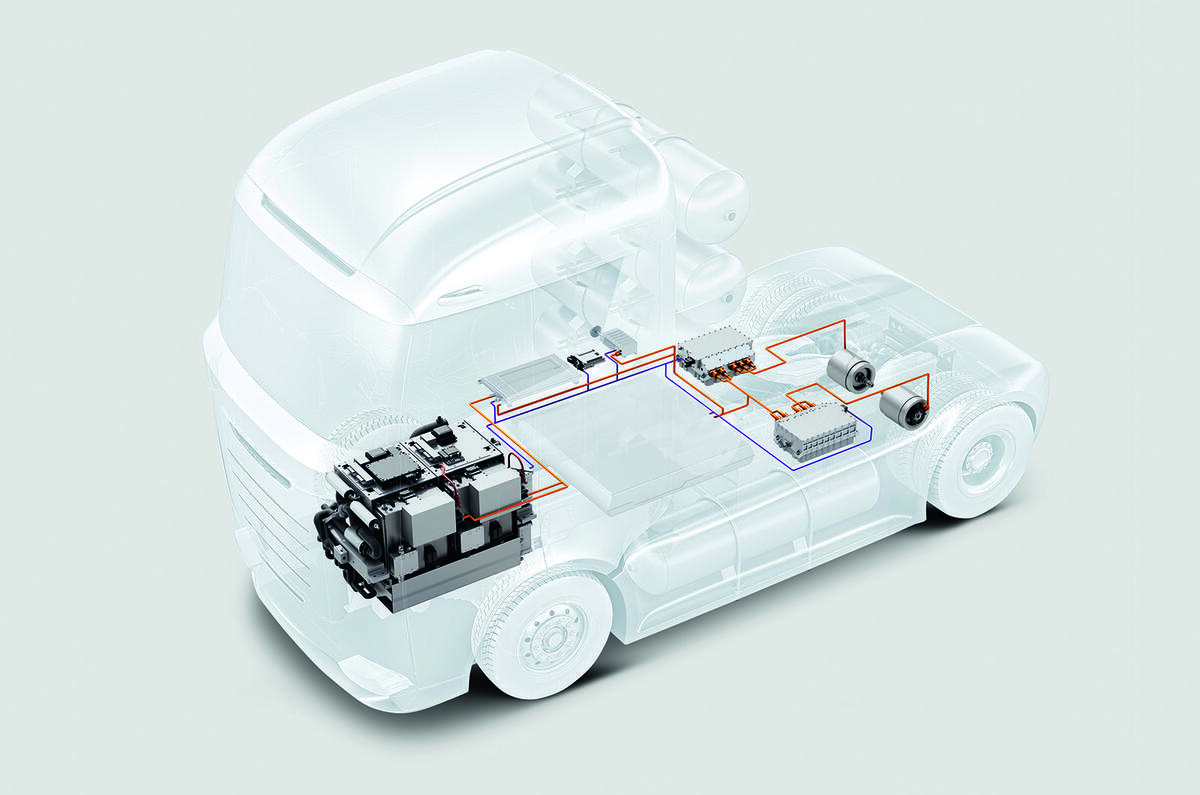

The plant, which will be repurposed from its current role making catalytic convertors, will make the proton exchange membrane, often described as the heart of the fuel cell stack.

Add your comment