Paul Willcox, an experienced industry executive who has enjoyed successful stints at the likes of Nissan and the Volkswagen Group, took the reins at Vauxhall last spring. On 1 June, he will become head of Stellantis in the UK, encompassing not only Vauxhall but also Citroën, DS, Jeep, Alfa Romeo, Peugeot and Fiat, who between them make around one in eight vehicles sold in the UK.

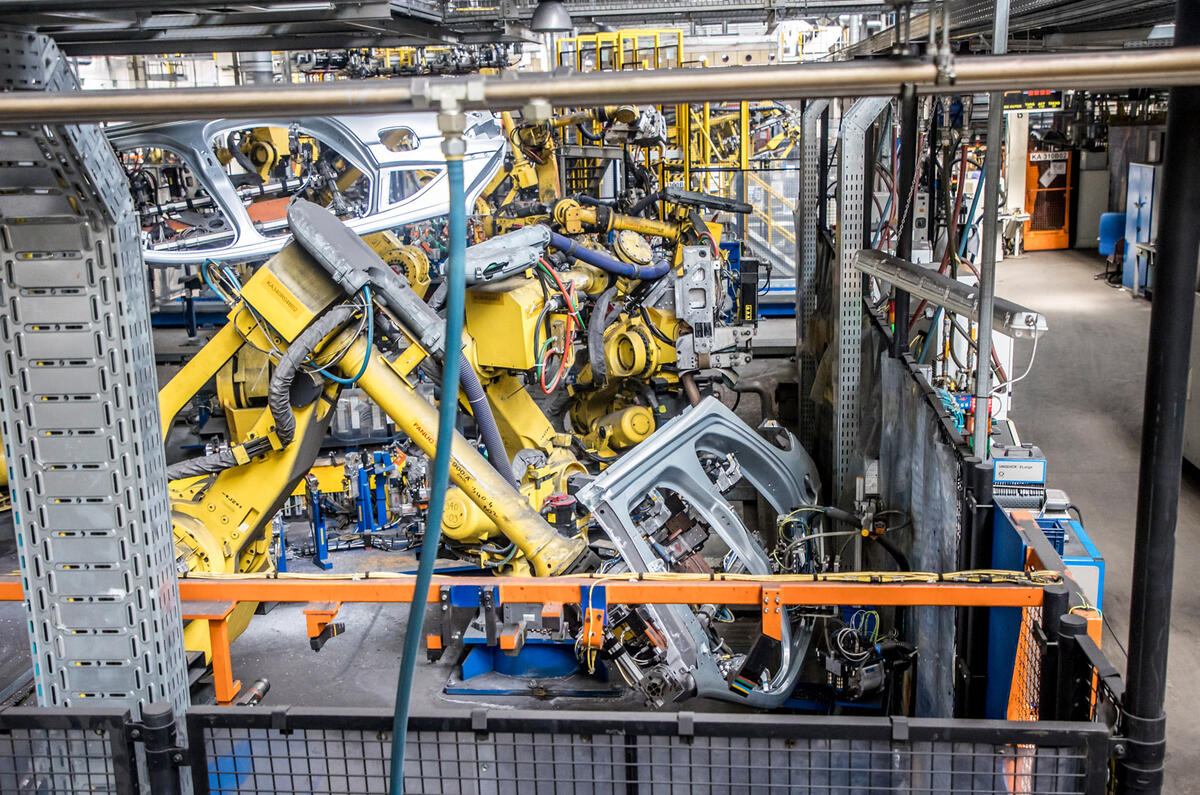

Here, he tells Autocar Business where the Vauxhall brand heads next, including a move to online sales, and a desire to secure the future of the Luton plant, to go with Ellesmere Port in building electric vehicles.

Add your comment