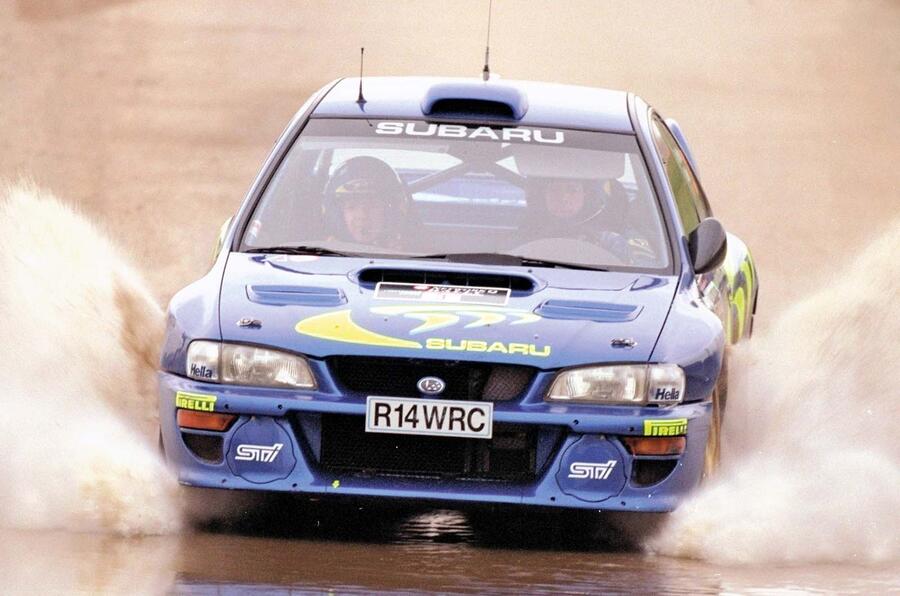

Word association time: what comes to mind when you think of Subaru? Easy: a blue and yellow Impreza flying sideways down a rally stage, somewhere around – or possibly just beyond – the limit.

Here’s something that doesn’t come to mind, though: electric vehicles. With the heavy cost of electrification and an influx of cut-price Chinese manufacturers, these are difficult times for even the largest car makers operating in Europe.

And for the smaller ones struggling for every sale they can get, it’s enough to make you wonder: why go to the trouble?

Subaru Europe boss David Dello Stritto understands why you might ask that. “You could think: ‘Okay, we’re selling around 30,000 cars a year in Europe and we’re doing around 700,000 in the US, so why bother?’” says the Scot. “That would be a fair question.”

Yes, Subaru is far more successful in markets where its utilitarian 4x4s are more in vogue and electrification is less of a hot topic – and its one-time great rallying rival, Mitsubishi, drastically scaled back its efforts in Europe years ago.

But with all the commitment of Colin McRae on the ragged edge, Dello Stritto says: “I’ll tell you what, Subaru Corporation has said repeatedly they have no intention of leaving Europe. They want to stay in Europe.”

He notes that Subaru couldn’t shift its European sales to the saturated American market – which already accounts for around 75% of the brand’s volume – and it’s struggling in China against domestic firms. But, most importantly, there’s pride at Subaru about being a global company.

So Subaru wants and needs to be present in Europe – but that creates a challenge. While large manufacturers can now hedge their bets and spread their resources between developing electric and combustion lines, smaller ones such as Subaru can’t. It’s partly why its early EV efforts, the Solterra and the forthcoming E-Outback (known in the US as the Trailseeker) and Uncharted, have been co-developed with Toyota.

“We have no choice,” says Dello Stritto. “We have to migrate from what we have today to a full battery-electric vehicle line-up in Europe as soon as possible. This is the vision.”

Subaru’s goal is to boost global sales from 976,000 last year to around 1.2 million by 2030, with around half of those cars being electric.

Join the debate

Add your comment

Governments may have strong confidence about going fully electric by 2035, but the problem is car makers and more importantly car buyers don't. It's those last two that basically make an open, free market where car makers produce what customers want to buy. Car buyers don't want electric, car makers are forced to produce electric while governments use the carrot and stick approach to try and control everything. In the meantime, the Chinese smell blood so flood EU markets with their own products. This is only going to end one way - badly.

Well yes but the truth of the matter is that the days of Subaru as a performance icon are long gone, since the BRZ and WRX went off sale over five years ago and neither were replaced, today there isn't a Subaru on sale that doesn't have a manual gearbox but the CVT Lineartronc auto. For the company electrification has not gone well the introduction of the Solterra & Uncharted both being rebadged Toyota's (Toyota owns 20% of Subaru) doesn't give much hope for the future. Over the past decade the company's market share has declined why is this? perhaps a shrunken dealer network,a reduction of the model range and the simple fact is the cars are simply too expensive, perhaps the best way to build up sales would be to have Subaru take over UK sales rather than rely on an independent agent then then they could have more control of how their products are sold here

If you need what a current Subaru gives you, they aren't really that expensive. They have deep-rooted, long term quality, although admittedly this doesn't mean much in a market where the majority of new car sales are two or three year lease deals.

The projected range of the Trailseeker isn't great though. Even with electrification, Subaru need to maintain a real tech differentiation.

Nothing wrong with the cars themselves, mind you. In fact, considering Toyota has a much larger presence, unless you have a really great experience with your Subaru dealer, why would you choose Subaru over Toyota?

Subaru are a niche brand, but great if you need a rugged go anywhere 4x4.

I went to Switzerland in the spring, and was really surprised with the number of Subarus I saw around..