Britain’s biggest commercial vehicle plant, Vauxhall Luton, last month started production of a new Vivaro van as part of a £100 million investment under new PSA ownership that secures 1250 jobs.

The new van provides Luton with long-term security, gives a huge vote of confidence in the plant’s ability to adopt PSA manufacturing and quality standards and potentially opens up opportunities to build other vehicles based on the PSA EMP2 platform, which also underpins the Vauxhall Grandland X.

“This is a very, very important investment for Vauxhall,” said plant director Mike Wright. “In less than two years, the workforce has turned this plant into one of PSA’s ‘European champions’. The amount of change at the plant has just been huge.”

Such accolades are particularly crucial when you consider how under threat Vauxhall's other major plant - Ellesmere Port - has appeared to be in recent months.

Five years ago, Wright guided Autocar through a tranche of £168m of investment that put the revamped Gen-3 Vivaro into production under GM ownership in conjunction with Opel and Renault, securing the Luton plant to 2025.

Now it’s all change after PSA bought Vauxhall/Opel in March 2017, with the Vivaro name switching to the design that serves as the Citroën Jumpy/ Dispatch, Peugeot Expert and Toyota ProAce Verso.

Like the outgoing Vivaro, it’s front-driven, but, being based on a platform that also supports SUVs, has refinements such as a multi-link rear axle, a more complex electrical system and a panoramic roof option for passenger versions.

Vauxhall Vivaro Life 2019 review

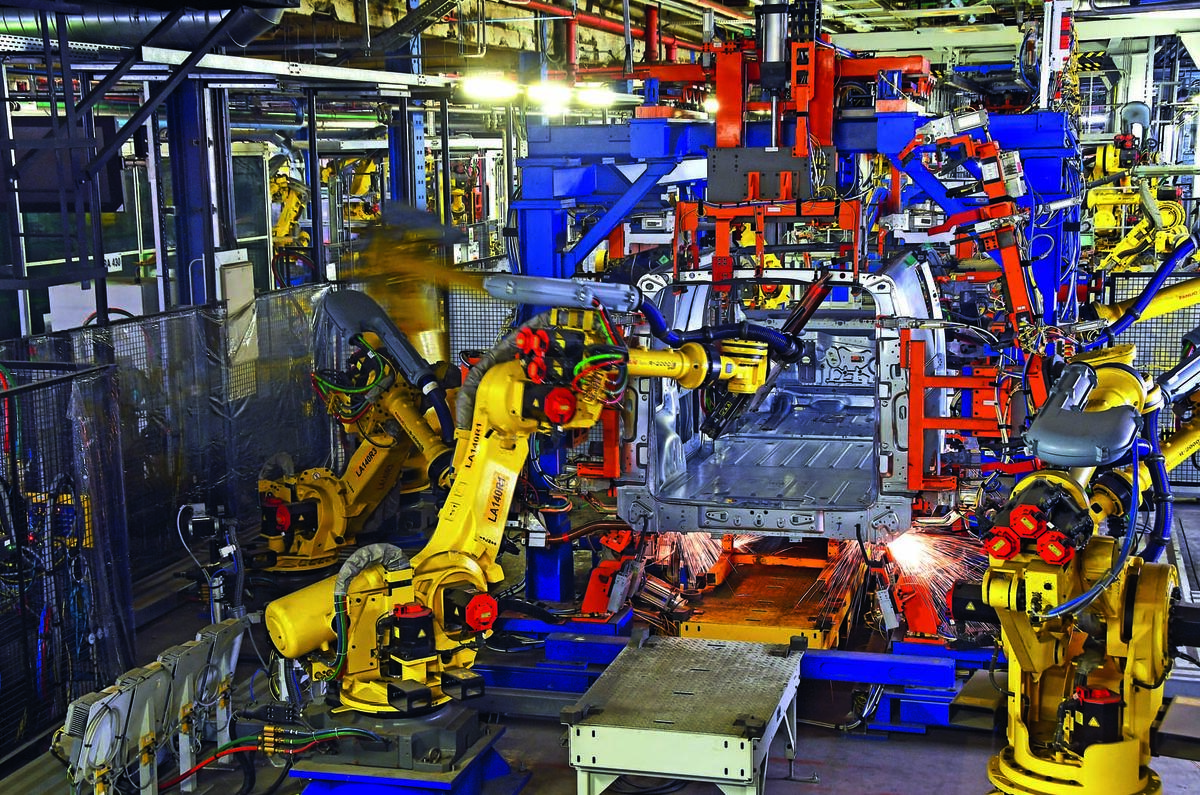

Switching to the new platform has required significant changes to the Luton plant layout. The bulk of the investment – £65m – has gone into a new, heavily robotised body-in-white assembly plant for the new platform.

To accommodate the new line, Vauxhall cleared out a cavernous 8000-square-feet underground car park and installed 300 new robots plus assembly jigs and mechanical handling gear capable of pushing out 24 chassis platform underbodies every hour. “With a lot of blood, sweat and tears, we’ve transformed this space and installed and commissioned a whole new chassis line in just 12 months,” said Wright.

Join the debate

Add your comment

@Hughbl

psa are and have been quite happy to throw all this time and investment in to the plant, basically getting the new ones rolled out as quickly as they can, so i'd imagine that if they're happy about things, we don't need to worry too much either. The 22% thing does sound a bit lower than ideal, however, as it states clearly in the article, given the timeframe that was never really going to be any higher, and will increase.

PSA proving to be the kick up the backside Vauxhall needed

I must admit I was very skeptical when PSA took over Vauxhall from GM, but so far they seem to making a good success from it. The new Corsa is already looking leaps and bounds ahead of the current model, and the sharing of new competitive platforms and engines is bound to boost the appeal of the Vauxhall brand. Hopefully the momentum can continue!

Good article, very

Good article, very interesting to see how a factory can be changed from making one product to another very different one

Must be an interesting challenge for the dealers though, if existing customers have a large fleet of the Renault based Vivaro, will they buy the new Peugeot based one or just buy the Renault Trafic instead?