The tale of Honda’s rise and fall in the UK and Europe is a chastening one. At one time, the firm was viewed as a genuine alternative to BMW, led by engineers making cars with cutting-edge petrol engines and sharp design.

In the 1970s sales success with the Honda Civic in the US was pioneering, while a joint venture with Rover in the 1980s broke new strategic ground.

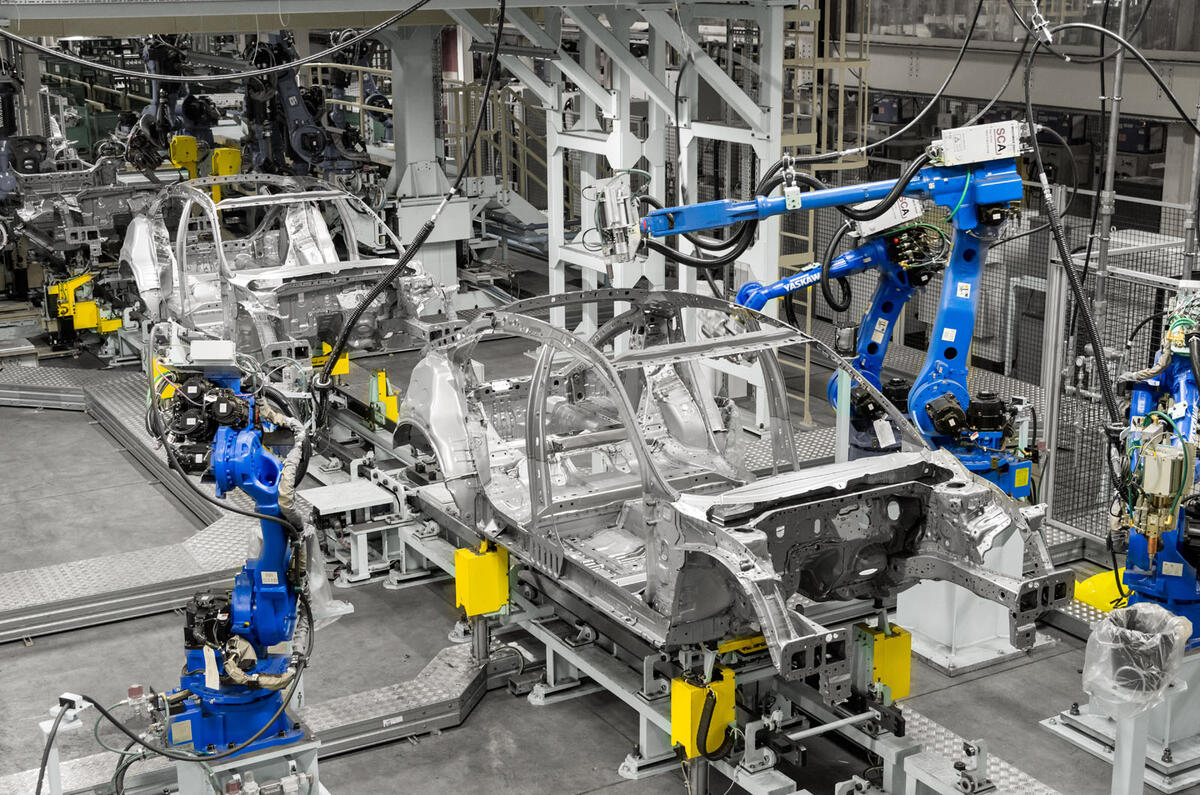

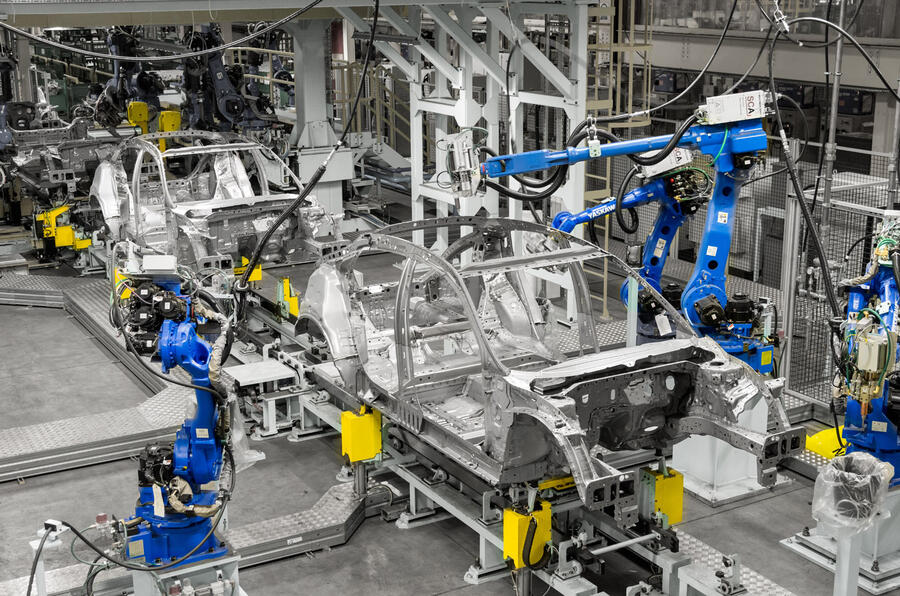

So when the Swindon plant opened in 1992 with the capacity to build 150,000 cars a year, just as Europe’s single market was launched, Honda looked set to conquer the continent.

Yet 27 years on, the relationship with Europe has soured: sales are in the doldrums, with just 150,000 cars shifted last year, and the £2 billion Swindon factory will close in 2021. Civic production will also stop at its Turkish plant, although “business operations” will be maintained.

So how did it all come to this?

Sales

Remember how well-loved Honda was in the late 1980s and early 1990s? There was the amazing Honda NSX sports car, the McLaren-Hondas that won everything in Formula 1 thanks to their turbo V6 and normally aspirated V12 engines, and the joint venture with Rover, all contributing to a solid toehold in Europe.

Back in 1990 Honda was selling 155,000 cars in Europe, compared with Nissan’s 371,000, Toyota’s 340,000 and Hyundai’s 18,000. After opening in 1992 with the Accord, the Swindon factory steadily boosted sales, rising to 225,000 in 1998.

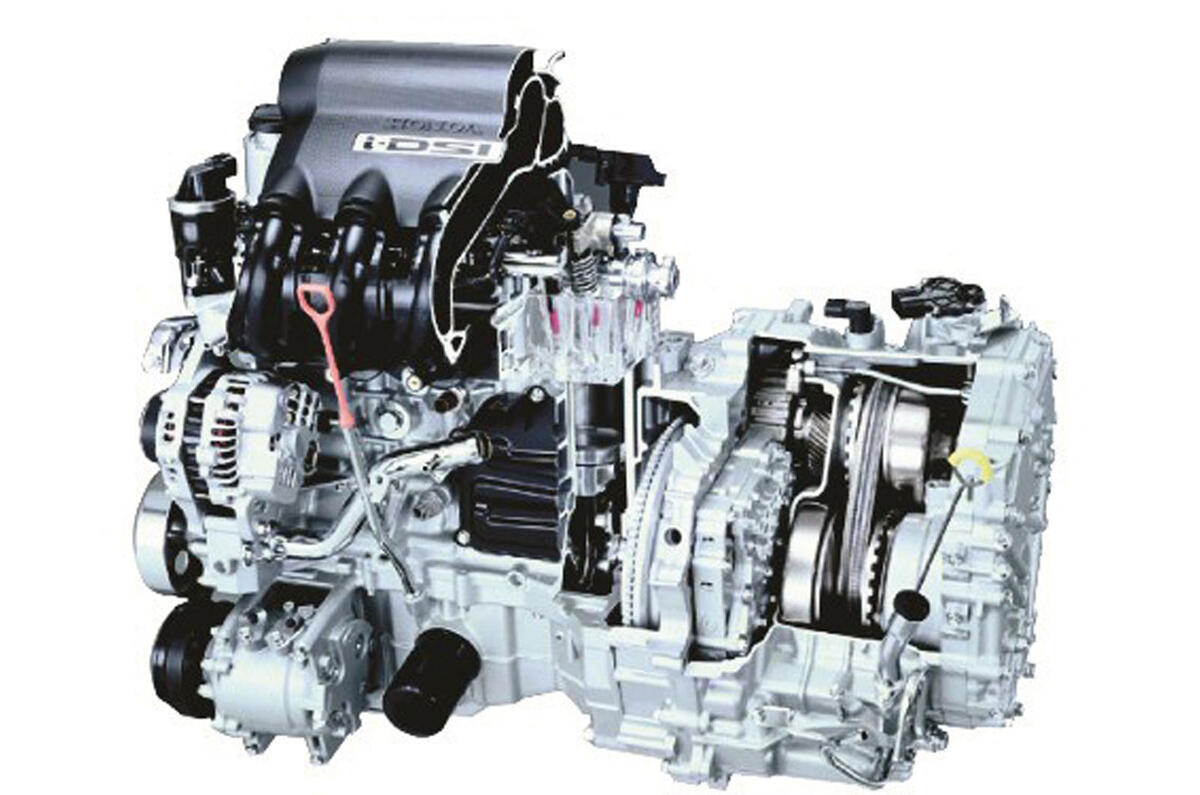

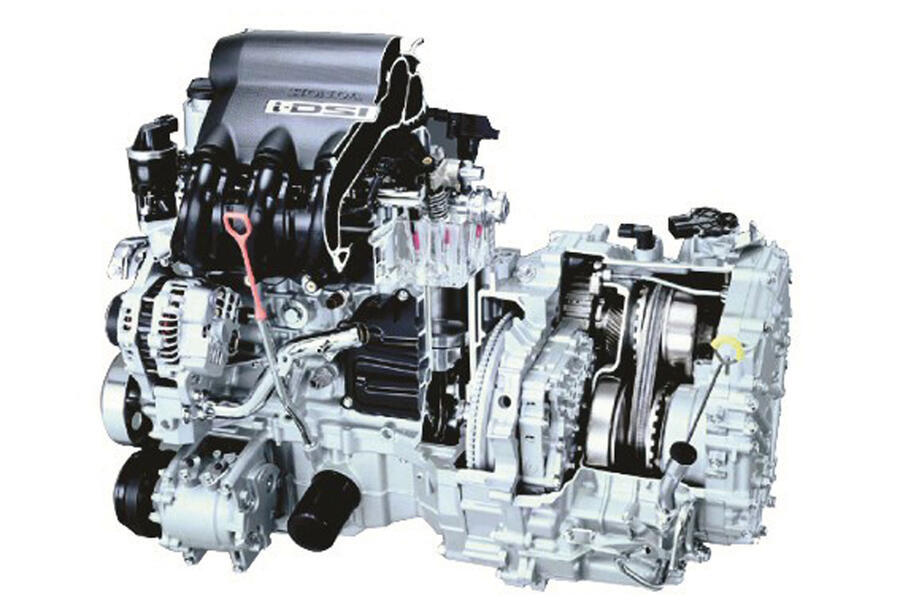

These were not easy years, however. BMW acquired Rover, rivals such as Hyundai were moving faster and Honda’s own diesel engine was a decade from production. In the meantime, it bought in its oil-burners from Rover.

Join the debate

Add your comment

NO WAY!

Management misjudged the market and made decisions that lead to demise of a factory?

No way! It is all Brexit! That is the culprit!

Once we are back under the wing of the tipsy Juncker & Co everything will be great!

Honda's problems NOT the responsibility of Swindon!

A detailed, comprehensive, full-and-frank, explanation of all the problems that trouble Honda . . . AS A COMPANY, and how it has arrived at this situation.Those problems have undoubtedly re-bounded upon, and negatively effected the Honda facility at Swindon.However, the problems that trouble Honda . . . AS A COMPANY, are in NO WAY caused by, or the responsibility of, the Honda facility at Swindon. It is well known, that the Honda automotive production facility, at Swindon, has an unbeatable reputation for the production of superb front-wheel-drive (FWD) vehicles.

The Japanese are off...

The EU Japan Trade Deal will eventually remove the need for Japanese car manufacturers to have any plants in Europe. Removal of the 10% tariff by 2027 will make it far cheaper and politically expedient to close their relatively expensive facilities here and use plants in the homeland, China and India,, transporting at no extra cost to Europe via the extensive global liner routes already operated by their shipping partners. Nothing to do with Brexit, everything to do with the EU shooting itself in the foot.