The incentives to buy an electric car in the UK may have been reduced, but more and more people are still making the switch away from conventionally powered vehicles.

So far this year, sales of ‘alternatively fuelled’ vehicles have accounted for around 4% of all new car registrations.

Britain is western Europe’s third-largest market for electrified cars, behind the Netherlands and Norway, where incentives are substantial, but the global trend tells a similar story.

March this year was the third-best month for electrified car sales in Europe, behind only December 2015 and 2016, when financial inducements peaked. The new Renault Zoe and the Nissan Leaf were the standard-bearers, chased by the plug-in hybrid Mitsubishi Outlander. Electrified car sales average around 1% of total sales across the region.

In the US, the mindset is anchored harder in big-bore petrol engines, but the signs of a shift towards EVs are still encouraging. In the first three months of this year, led by Tesla but boosted by ongoing sales of the Leaf and the new Chevrolet Bolt, fully electric cars accounted for more than 1% of sales for the first time, a year-on-year rise of 74%. Sales of hybrids are growing at a similar rate.

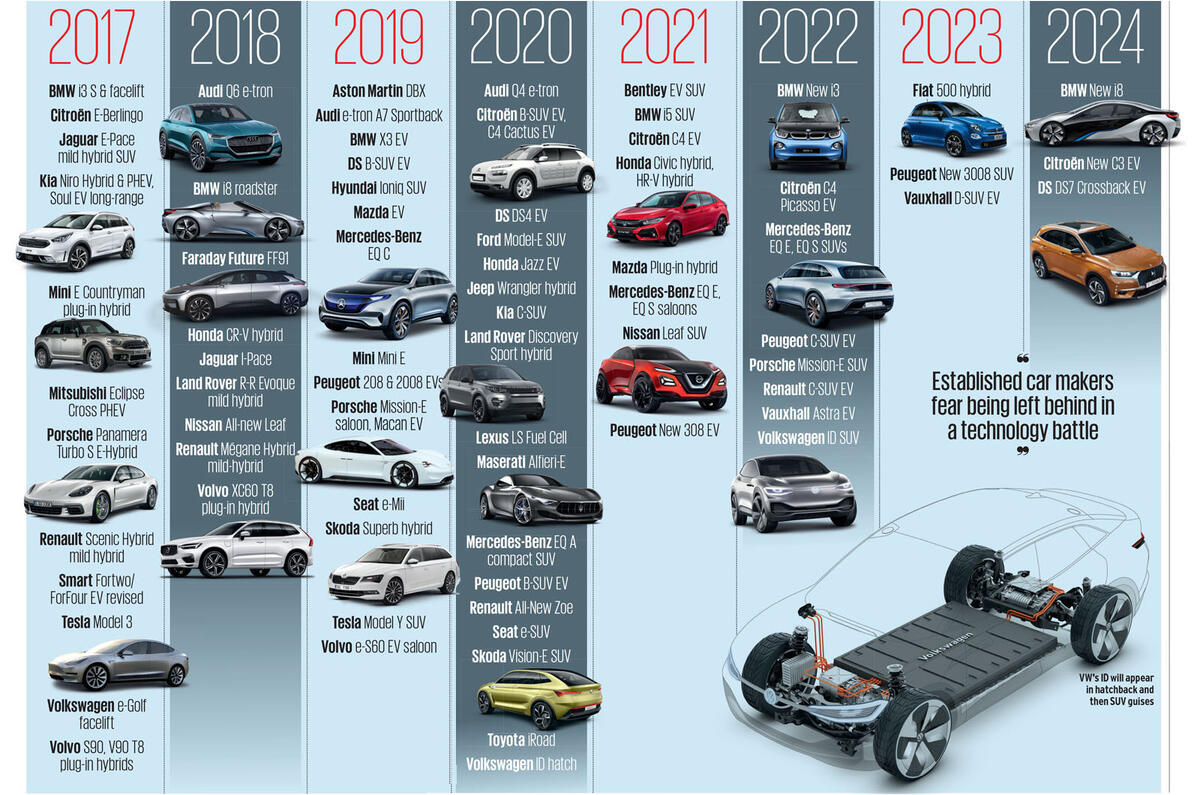

Little wonder, then, that the table to the right highlighting the EV plans of the established global car makers is jampacked. Despite a veil of secrecy over future products, Autocar has uncovered at least 100 new EVs and hybrids due to be launched in the next eight years as the shift to electrified powertrains takes hold. Using published sources and industry contacts, the multi-billion pound investment plans of the car industry to launch large numbers of battery electric and hybrid models is laid bare.

And yet in Europe and the US this growth is more of a creep than an avalanche, and even the most ambitious projections can’t account for the levels of money being invested to develop these cars. For comparison, fewer than 4000 Renault Zoes were sold in Europe in March, compared to just under 48,000 Ford Fiestas. Furthermore, profit margins, even on big-ticket Teslas, are said to be waferthin, to the point of making any hope of a return on investment unlikely for years to come.

So what’s driving this trend? Firstly, and most publicly, the much-heralded emissions targets, led in Europe by the EU’s fleet-average CO2 target of 95 g/km in 2021 and then the next target — possibly as low as 70g/km — by 2025. The regulations are broadly echoed around all global markets, albeit to varying degrees, and underline that legislators and public health officials are determined to reduce carbased emissions come what may. Whether or not there is public demand for the cars they make, manufacturers cannot afford to flout the rules. Even so, that doesn’t explain why many are jumping into the technology wholesale.

Join the debate

Add your comment

Infrastructure and taxation will impact Global addoption of EVs

The Chinese have there established strategy to gain competitive advantage through early adoption of EV technology and thereby enable economically viable entry into the mature automotive markets. Equally the established brands are fully aware of the need for EV product to defend their share of the 25m plus Chinese market. However, there is growing pressure in Europe and the USA for cleaner transort, especially within Cities and urban areas. By 2025, there will be no go areas for ICE vehicles, particularly in regard to personal mobility.

Government will have to invest in electricity generation and distribution to enable 20% of new car sales to be EVs, even if they are recharging overnight when traditional demand is low. Equally government doesn't want to lose the automobile as a revenue stream, therefore, a new digital road use formula will probably be adopted, at a significant cost.

There will be some other down sides, such as a likely increase in distribution costs of petrol and diesel when demand starts to decline. Some brands may disappear due to the costs of adopting the new technology.

On the positive side, we should have a cleaner environment, however battery disposal may be an issue, and EV platforms lend themselves to autonomous vehicles particularly well.

Whatever, this will be a decade of greatest turmoil the industry has experienced and should fuel some great advances.

Greater electricity generation capacity will be needed globally?

Is the infrastructure there to cope?

I thought we were borderline for electricity generation already?

Have established car makers really 'let' Tesla take the lead?

Is it perhaps more likely that they were blindsided by the success of the Model S, which has taken significant sales in the luxury sector, and have been struggling to catch up ever since?

To any long-term observer of the automotive sector, this seems far more likely as a scenario.

But obviously Autocar needs to flatter its advertisers.

Perhaps this is why Autocar keeps focussing on the market share of EVs, when the more meaningful statistic is the year on year growth. This growth is significant and goes a long way towards explaining why so many new EVs are in the pipeline.