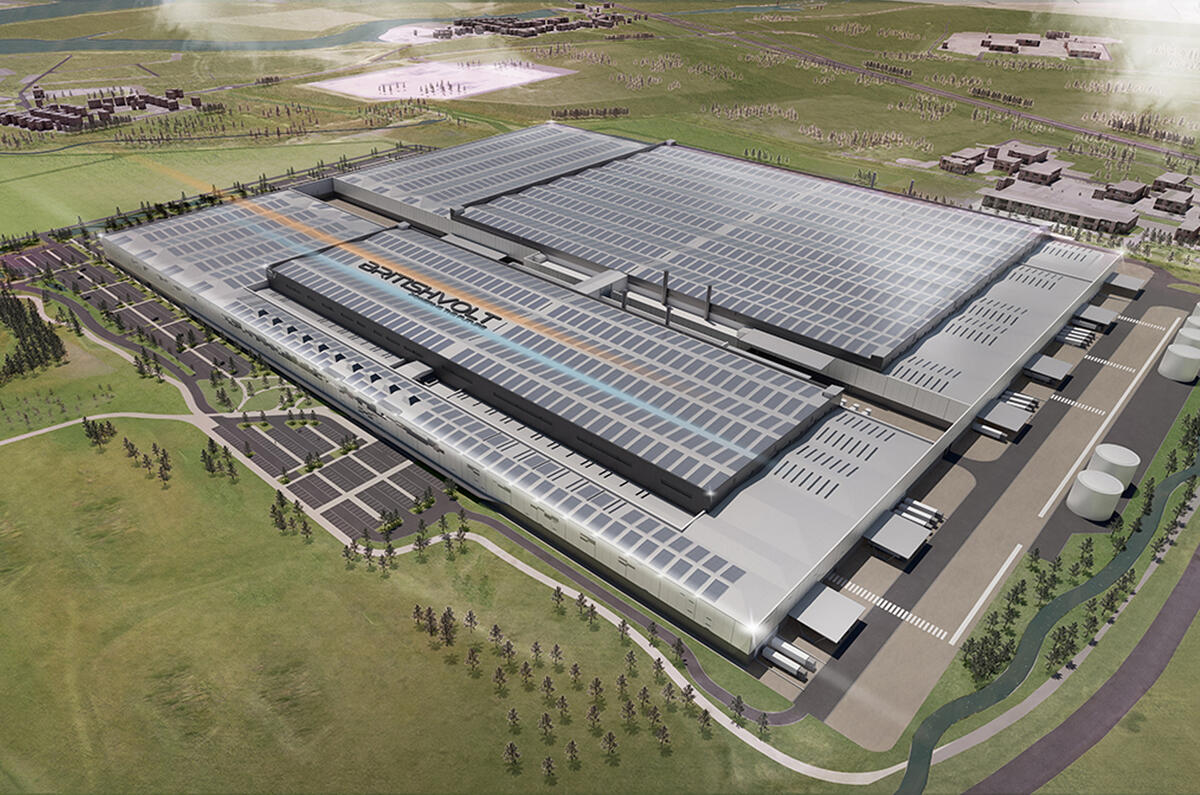

Troubled battery start-up Britishvolt has been given a lifeline to keep the firm going "over the coming weeks" after an anonymous investor stepped forward to temporarily hold off administrators.

The Blyth-based firm hopes it can secure more long-term funding during this period, confirming it has "received promising approaches" from several international investors in the past few days.

Join the debate

Add your comment

300 employees doing what? Because it doesn't look that they're producing any batteries. Not seen a single one from Britishvolt.

The only asset is the land, and there's plenty of other sites. Some in the EU that are more favourable and closer to the markets after Brexit put up barriers.

Trying to do something like this is always going to be challenging, trying to do it with absolutely no expertise and needing multi-billion dollar investments is the work of fantasists. And even if you did have the expertise, and someone crazy enough to pour in the funds, after Brexit you wouldn't risk that level of investment in Britain.

Well, IMO, the need for a large UK-based li-technology battery factory is so imprtant to the future of the country that HMG should do whatever is needed to get Tesla to take over the development of this site, you know, a company that has the knolwedge, experience, forsight, energy and quality of management to *get it done*.

Clearly the whole thing was originally concieved to make a small number of individuals very rich on the back of the 'EV-thing' at the expense of the UK tax-payer.

Now talk of another company, which seems to be as much of an expert in making batteries as BritishVolt (i.e. none) wanting to merge with them? Take nothing, mix in more of nothing, and what do you get?